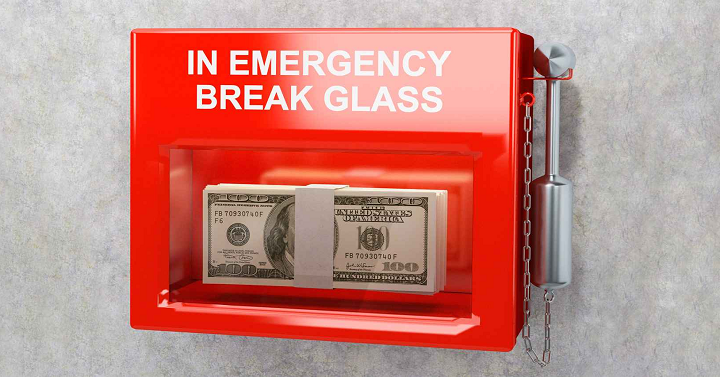

Let me tell you guys what happened this week and how I realized the importance of having an emergency fund account. I pay our household bills through bill pay (online through our bank). I had to change the amount for our mortgage and when I did this I entered in the wrong amount causing us to be out an extra $1,000! Long story short I was able to put a stop on our check and get the funds back but for a short time we had nothing for any bills coming out, grocery we might have needed etc. So I wanted to break down for you why it’s important to have an emergency fund account and just how much you should have.

An emergency fund account is just that, in case of an emergency. In our case we had the funds available for that check to go through so we avoided any financial fees that could have happened had we not had extra funds available. But this also includes a job loss. It can take some time to get another job so having an emergency fund account will help while you search. You also don’t know when a medical emergency might happen so having these funds set aside will help ease your mind with everything that’s going on during a medical emergency. And don’t forget your furry family members, they might have medical emergencies too.

You also need to be prepared for unexpected car and home repairs. These can get pricey depending on what needs to be fixed but having those funds there to use when a problem arises will help. Please don’t think just because you have insurance it will be covered (but insurance is still a good idea), that’s not always the case. And depending on your coverage it might not cover any of it.

Ever been shocked by your tax return? Hopefully it’s been for your benefit but if you’re not keeping track of your withholdings this can be a shocker when you’re having to pay a lump sum to the government. Keep that emergency fund in mind if when a larger than expected expense happens.

Hopefully it doesn’t happen but funerals to family members can be a burden on your wallet if they’re out of state and you’re wanting to attend the funeral. Keep your emergency savings account filled so that you can pay for those unexpected travel costs.

So just how much should you have in your account? For us right now $1000 is what we can afford to have. This will help cover us if the water heater goes out, the fridge dies or it will soften the blow if a medical emergency comes up. But in the long run we’re working on getting at least 3 months of expenses saved. This will be different for everyone depending on where you live and how many people you care for but if a job lose comes up or a bigger emergency, it would be nice to have those funds available.