There could be hope on the horizon for many small businesses and some individuals affected by the coronavirus pandemic. Not only did the Coronavirus Aid, Relief, and Economic Security (CARES) Act drastically expand unemployment eligibility and provide $1,200 stimulus checks to most Americans, it also extends help to small businesses around the country.

The Small Business Association (SBA) is now able to give out Economic Injury Disaster Loans (EIDLs) with some very favorable terms and other perks.

One of the most notable perks includes the $10,000 emergency cash grant available to applicants. Even applicants the do not qualify for an emergency loan, they are still able to get the $10,000. This advance does not have to be paid back and will be forgiven as long as it is used to “address any allowable purpose”, such as:

- providing paid sick leave to employees unable to work due to the direct effect of the COVID–19

- maintaining payroll to retain employees during business disruptions or substantial slowdowns

- meeting increased costs to obtain materials unavailable from the applicant’s original source due to interrupted supply chains

- making rent or mortgage payments

- repaying obligations that cannot be met due to revenue losses

Emergency funds are supposed to be distributed quickly. There’s no word yet, though, on how long it will take small businesses to receive the money.

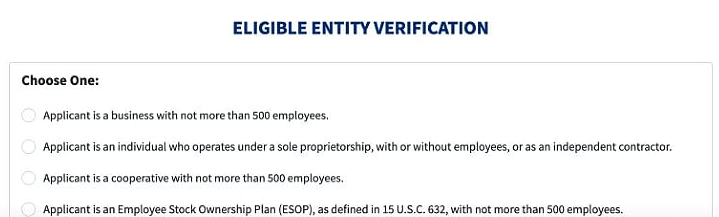

Eligibility for an emergency EIDL grant has also been expanded under the CARES Act. Eligible entities include:

- a business with not more than 500 employees

- any individual who operates under a sole proprietorship, with or without employees, or as an independent contractor

- a cooperative with not more than 500 employees

- an ESOP with not more than 500 employees

- a tribal small business concern with not more than 500 employees

This includes many freelancers, self-employed individuals, and gig workers. For instance, AirBNB hosts, daycare owners, and Uber drivers impacted by the coronavirus pandemic can apply for an EIDL and also possibly qualify for the $10,000 grant, even if they are denied the loan.

The SBA’s EIDL loan terms are also quite favorable. Small businesses can borrow up to $2 million, and interest rates will not exceed 4%. There are also no loan fees, guarantee fees or prepayment fees.

Here are a few more points to consider when applying for an EIDL from the SBA:

- Businesses must have also been in business since at least January 31st.

- Loans can be approved based solely on an applicant’s credit score, not repayment ability.

- No tax return is required.

- Loans smaller than $200,000 can be approved without a personal guarantee.

- Real estate is not required as collateral.

Since funds are limited, though, it’s important to apply as early as possible, since there will be a huge demand for this relief.

Here’s how to apply for an EIDL loan and $10,000 advance.

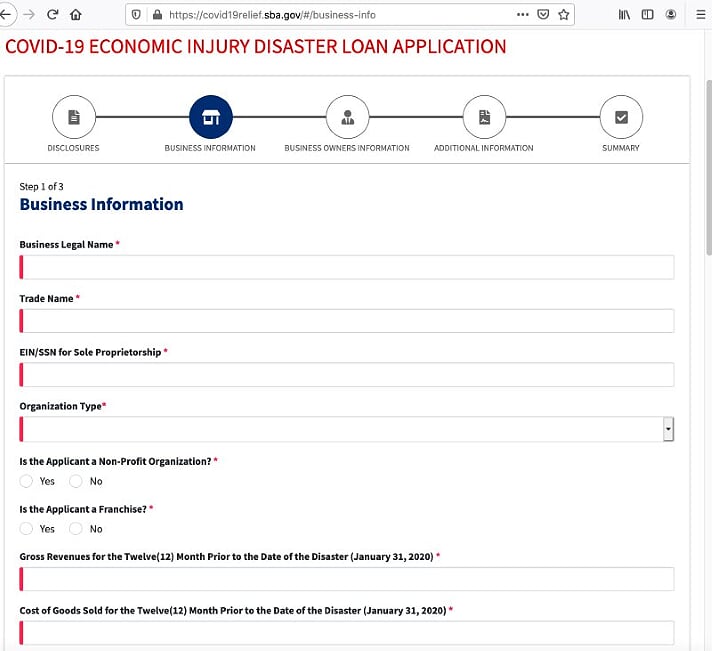

- Go to the sba.gov/disaster and click on the red button that says “APPLY FOR ASSISTANCE”.

- Choose the type of eligible entity you are applying for.

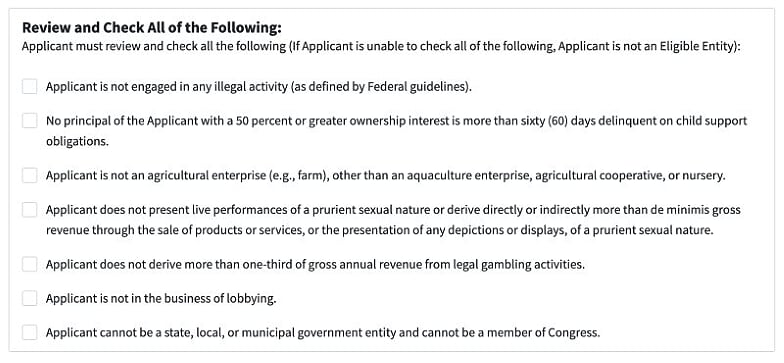

- Make sure to check all of these options on the same page, if they apply, and move on to the next page.

- If you are applying for a business, put the legal business name in the business legal name and trade name space. Put your EIN. Choose your business type.

If you are applying as a sole proprietor then put your first and last name in those spaces instead, and enter your SSN. Choose sole proprietor prop as the organization type.

Gross revenue is the amount of sales you had for the past 12 month. Cost of goods sold is the expenses you incurred in the last 12 months.

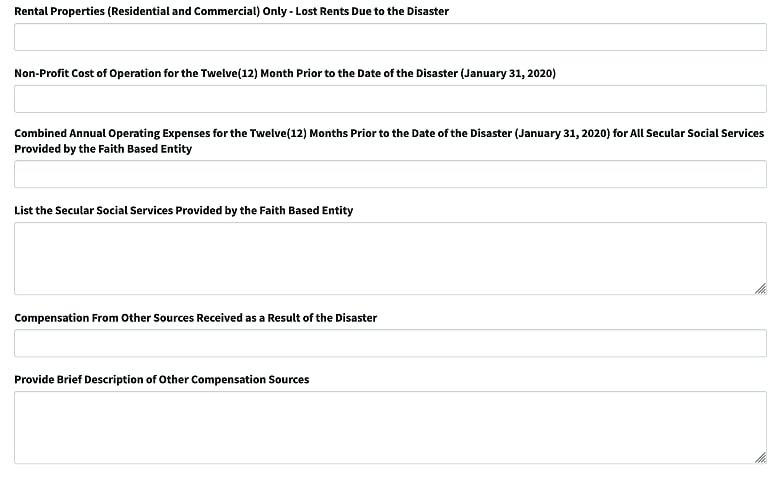

- Leave all this blank if it doesn’t apply to you. The only thing that may apply is the lost rents for some people that have rentals. Put the amount you expect to lose as a result of coronavirus.

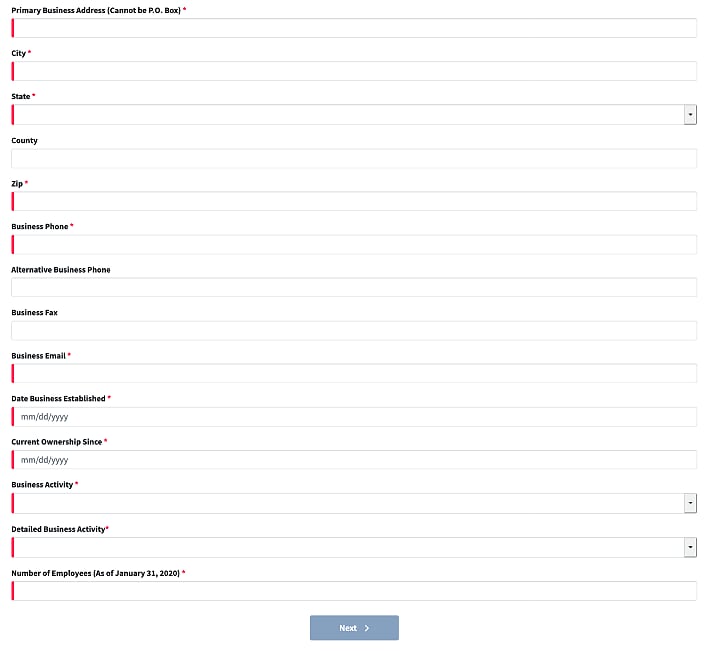

- Fill in all this info. If you are a sole proprietor, put 1 for number of employees since you are the only employee, and move onto the next page.

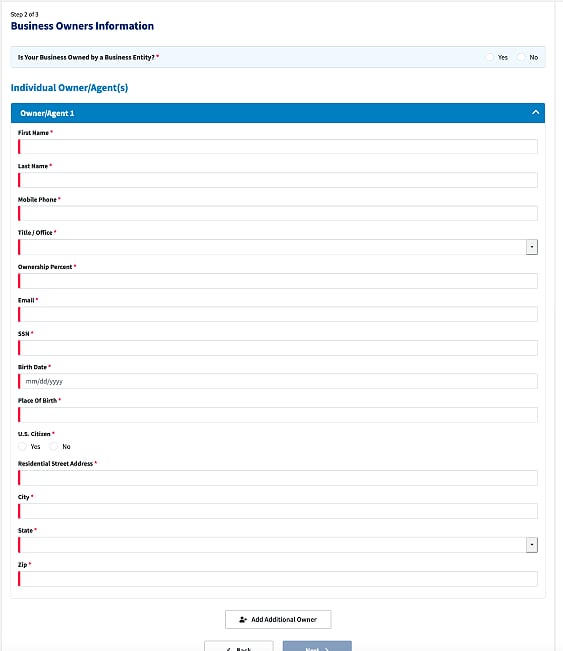

- Most people will choose NO for the “Is your business owned by a business entity?” since either their business is owned by the individual or it is a sole proprietorship. Fill out the rest of the info and move onto the next page.

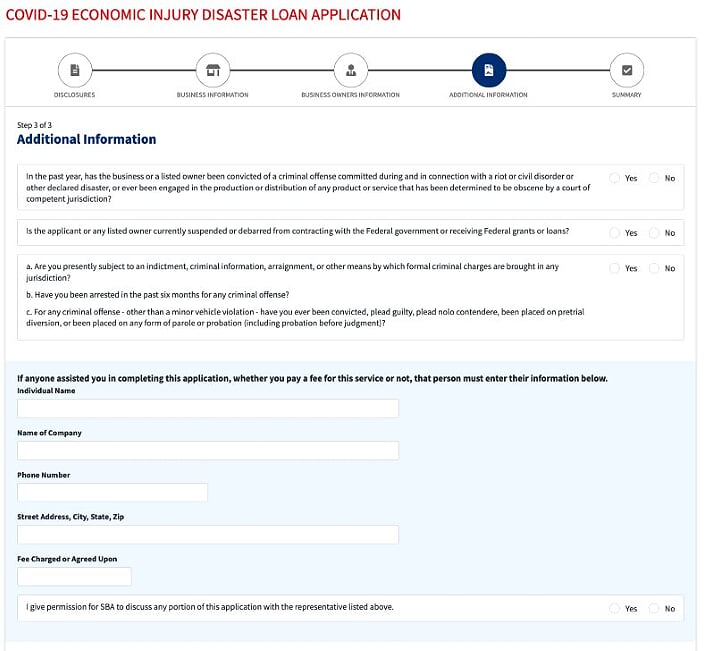

- Choose no for the first 3 questions. That is of course if they all don’t apply.

Leave the blue section blank that asks if anyone helped you fill it out. IMPORTANT: Do not accidentally type in this section because if you do that and delete, it will glitch and will require it, and you’ll have to restart the application.

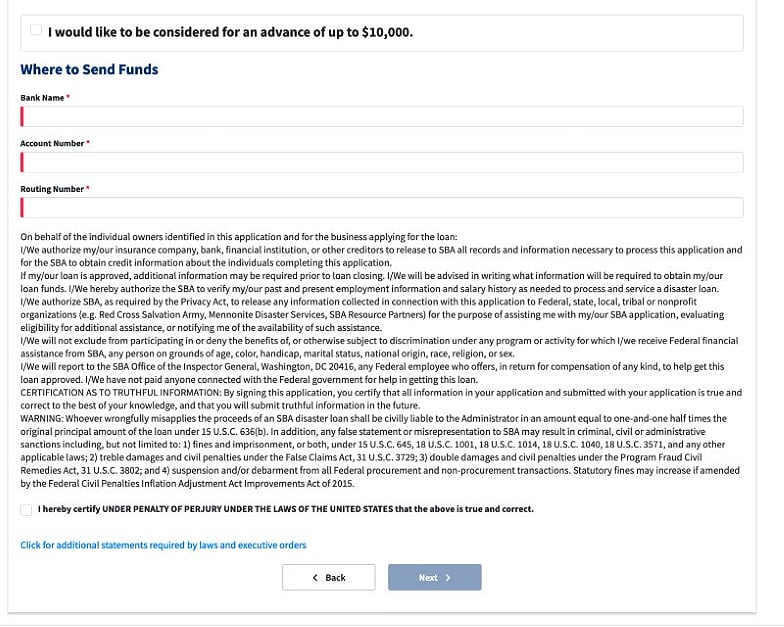

- THIS IS THE IMPORTANT ONE. Make sure to check “I would like to be considered for an advance of up to $10,000.” Make sure to check it and put your banking info. Your bank name is the institution of where you bank. Your account number is your account number. The routing number doesn’t state whether it wants the routing for wires or ACH, so if your bank has multiple routing numbers, I believe the safest bet would be to put the ACH routing number, since most government deposits are done electronically. Check the box and move onto the next page.

- Read the disclosures, hit the captcha, and submit the application.

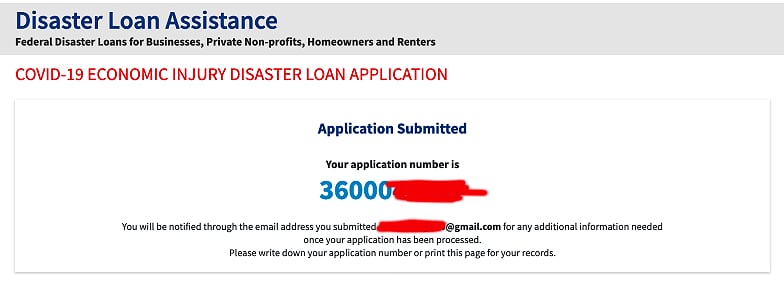

- You’ll get a confirmation #. Be sure to write this down so you can reference it if you need to.