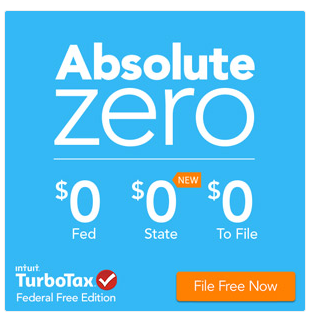

YAY! For the first time ever you can file both your Federal and your State Tax Return for completely FREE online with TurboTax! Usually we get Federal FREE and still have to pay for State! I’m seriously excited about this and all of you should too!

That means starting today, you can get a head start on your return by filing both Federal & State with TurboTax for absolutely $0, and your return will be held securely and submitted once IRS e-file opens on January 20th. How awesome is that?! Head over here to see the details.

TIP for Filing Taxes: As soon as you start getting your W2’s or 1099’s from Employers, add them into your Turbo Tax online filing. The thing I love the most about doing taxes online with Turbo Tax is that you can see where your return is at during the entire process. You can see if making certain deductions will give you more money back or less. And it’s great to see where you are at during the process… instead of having it a big surprise at the end!

**Note that the Free State and Federal Tax Filings from Turbo Tax are only for Simple Returns. If you own a home, have charitable deductions or other more complicated items to write off, you will still have to pay for your returns. However, I will be on the lookout for awesome deals on the more complicated tax software for you!

Marnee

Last year, for the first time, H&R Block req

Marnee

Hmm. I don’t know how I entered that last comment prematurely.

Last year, for the first time, H&R Block required us to use a paid filing option in order to count our EIC credit. So I’m on the hunt for free ways to file taxes that allow you to count EIC. Any ideas?

Courtney

So you probably can’t do this one if you have kids, right?

joey

You can do it with kids.

Courtney

oh great, thanks you! I’ve always just bought the deluxe + state, but I have a pretty simply return. Thanks!

Melanie

I usually buy the deluxe plus state from Costco when it’s on sale. You can file your Utah state taxes for free on the Utah tax website and just use the information from the state taxes from turbo tax.

Meghan

Thanks, I didn’t know that!

Alicia

You can file federal and state FREE (including EIC, etc.) using thebeehive.org if your income is less than 58k. We have used it two years in a row and have gotten the exact same number as more expensive tax software. Also, if your income is under 52k (or s0) you can have someone do your taxes for you in person for FREE compliments of the Volunteer Income Tax Assistance Program (VITA). We have used their program as well in the past and have been happy with the service. Info for both can be found on thebeehive.org.

Janelle

I’ve used H&R Block free online for years, (I only use Federal) including owning a home, buying a home, short selling a home, itemizing deductions, etc.

Summer Green

The fine print on this is it doesn’t actually end up being free:( It’s one of the biggest misleading statements out there. When you look into it you find out they actually take your State return fee out of your refund…so so false advertising!!

Calli

We always use taxactonline.com. If you want to do paper returns you can do it for free, but if you want to e-file you have to pay, but I think the most I’ve ever paid to efile both federal and state was $17.99. It saves info from year to year too which saves me a ton of time too.